GTA REALTORS Release September Stats

TORONTO, ONTARIO, October 4, 2023 – The impact of high

borrowing costs, high inflation, uncertainty surrounding future Bank of Canada decisions and slower economic growth continued to weigh on Greater Toronto Area (GTA) home sales in September.

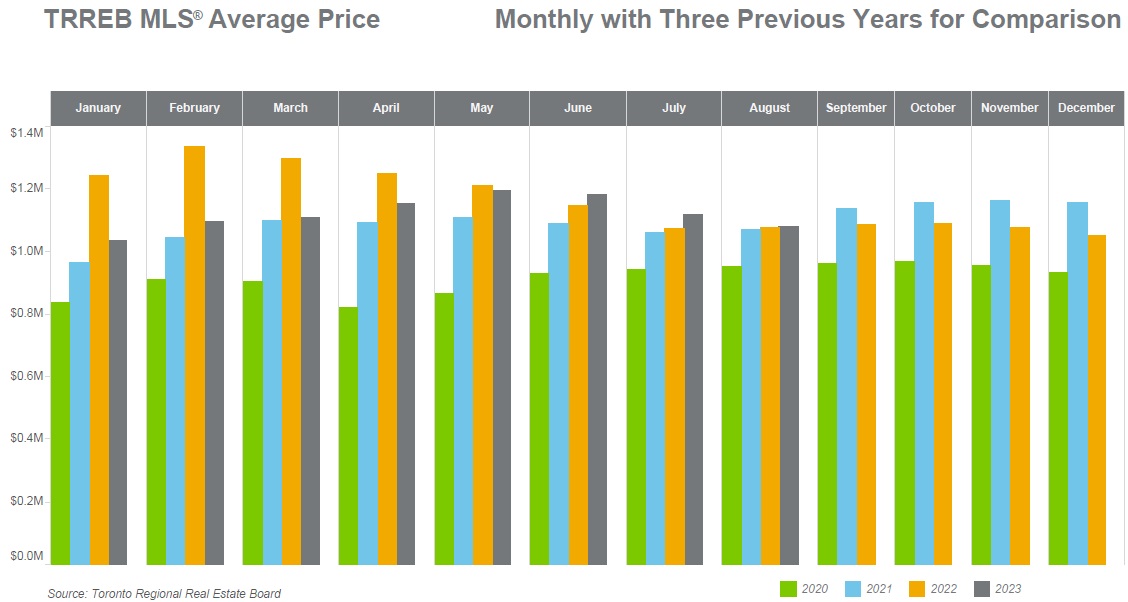

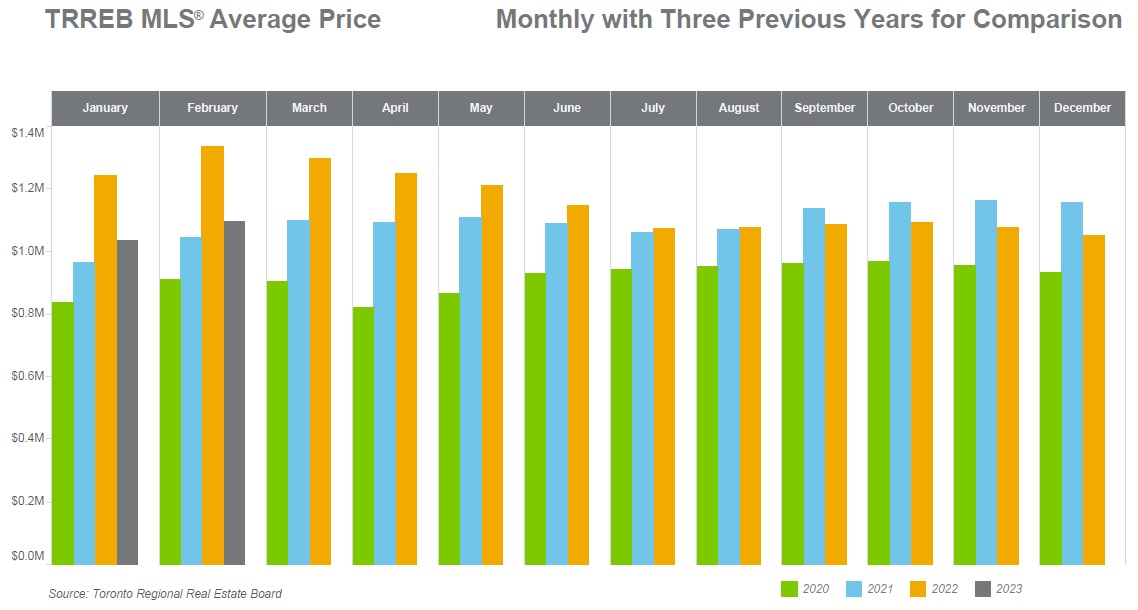

However, despite the market being better-supplied with listings, the average selling price was up year-over-year. “The short and medium-term outlooks for the GTA housing market are very different. In the short term, the consensus view is that borrowing costs will remain elevated until mid-2024, after which they will start to trend lower. This suggests that we should start to see a marked uptick in demand for ownership housing in the second half of next year, as lower rates and record population growth spur an increase in buyers,” said TRREB President Paul Baron.

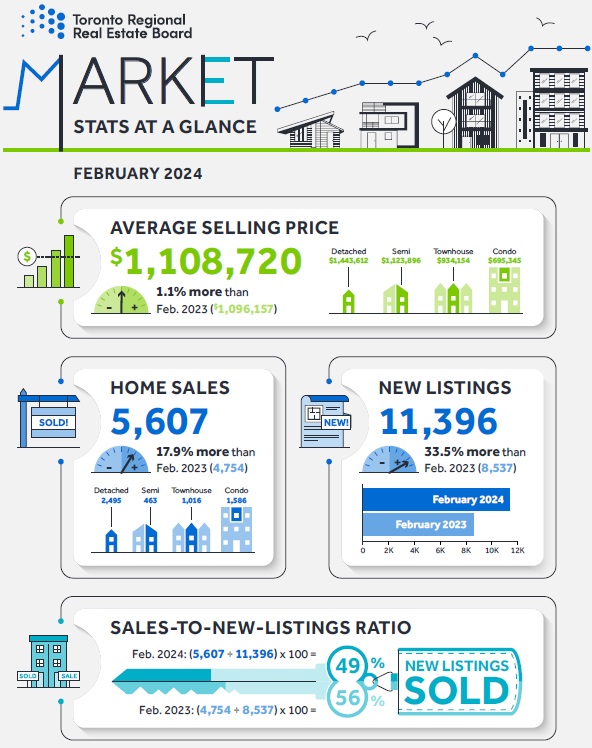

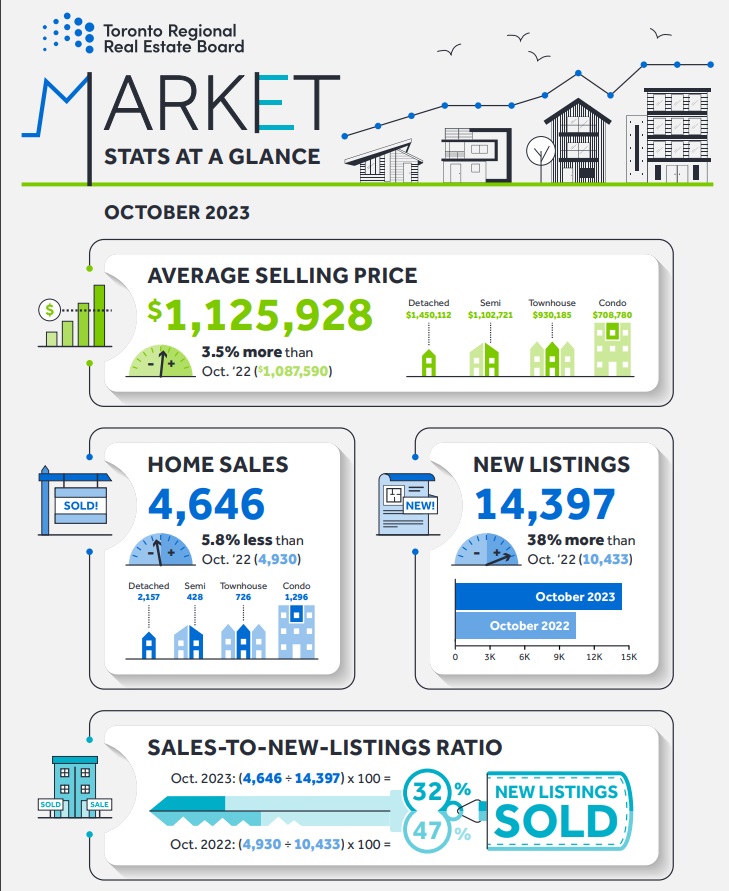

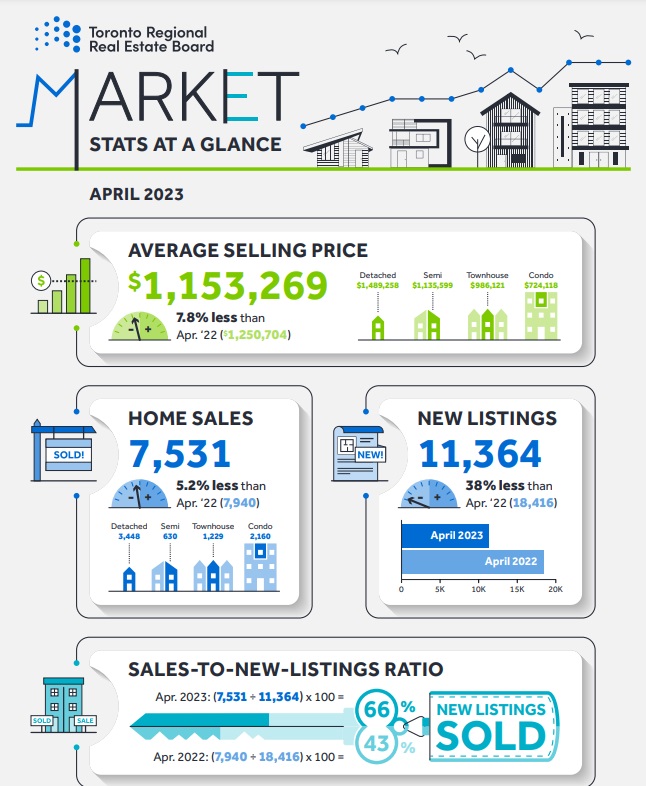

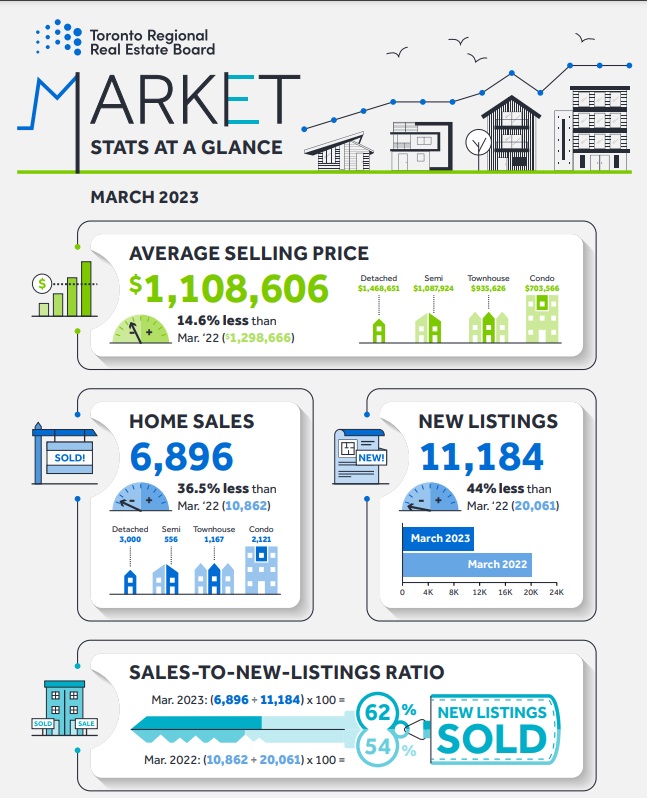

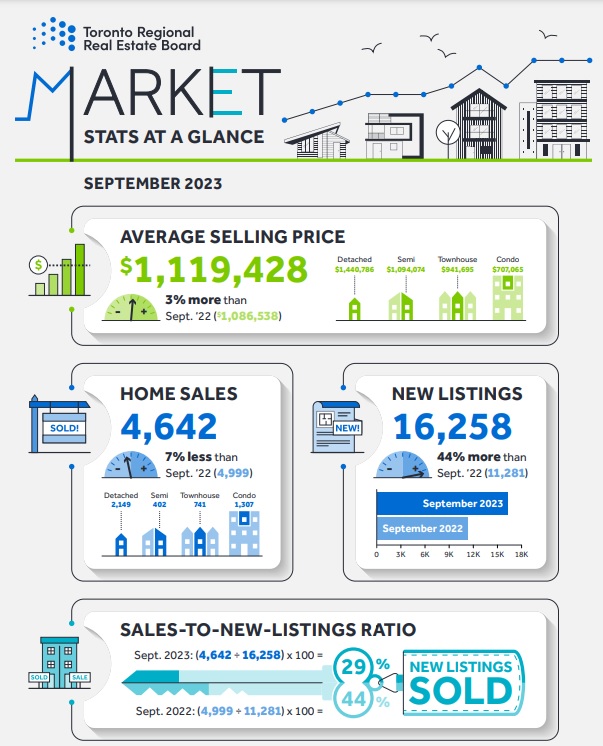

REALTORS® reported 4,642 home sales through TRREB’s MLS® System in September 2023 – down 7.1 per cent compared to September 2022. The year-over-year dip in sales was more pronounced for ground-oriented homes, particularly semi-detached houses and townhouses. On a month-over-month seasonally-adjusted basis, sales were also down slightly. New listings were up strongly on a year-over-year basis from the extremely low level in September 2022. The number of listings also trended upward on a month-over-month seasonally adjusted basis.

The MLS® Home Price Index (HPI) Composite benchmark was up by 2.4 per cent year-over-year. The average selling price was up by three per cent over the same time period. On a month-over-month seasonally-adjusted basis, both the average selling price and the MLS® HPI Composite benchmark edged lower by less than one per cent.

“GTA home selling prices remain above the trough experienced early in the first quarter of 2023. However, we did experience more balanced market in the summer and early fall, with listings increasing noticeably relative to sales. This suggests that some buyers may benefit from more negotiating power, at least in the short term. This could help offset the impact of high borrowing costs,” said TRREB Chief Market Analyst Jason Mercer. “TRREB’s annual consumer polling has shown that half of intending home buyers in Toronto will be first-time buyers in any given year. The average price of a condo apartment in Toronto is over $700,000. Yet, the first-time buyer exemption threshold for the City’s upfront land transfer tax has remained at $400,000 for a decade-and-a-half. With this in mind, TRREB applauds Toronto City Council for asking City staff to provide a report on a more appropriate exemption level moving forward,” said TRREB CEO John DiMichele. He further stressed that “many housing and taxation policies are currently set in opposition and we need all levels of government to align policies and work together to solve this housing crisis.”